ANSWER: How about that Bitcoin ??

You only need to buy as much Bitcoin as you require - plus about a few dollars for send fees

Using Bitcoin is easy here with a Smartphone

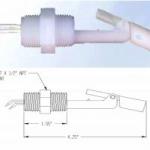

1. Use the link button or other source on this page on this page to set up a Bitcoin buying account somewhere. (You can also travel to a Bitcoin ATM if you have a Bitcoin wallet ready)

2. Download your favourite smartphone Bitcoin app (be sure it can send payments from QR Codes)

3. Send your Bitcoin there to the wallet

4. Make a purchase and generate a QR Code here after the purchase using our QR Generator

5. Scan the QR code with the phone, verify the amount and fee desired then send the payment.

---- OR using this, the computer you purchased on ----

1. Copy the address you were supplied in the Order email - at the bottom or checkout page

2. Paste it into your wallet containing your bitcoin in the "send" section

3. Copy the amount due in the amount box and verify the amount and fee desired then;

4. Hit send

There are "bitcoin atm" machines where to easily buy Bitcoin located around the US - here is a page with some instructions on using them and a way to search for one near your location => https://coinatmradar.com/blog/how-to-buy-bitcoins-with-bitcoin-atm/

Read more below for other - sometime cheaper - buying options and information about Bitcoin - but have your Bitcoin purchasing and paying system set up before you buy - because the price of Bitcoin changes by the minute if you are not ready to purchase and pay at the same time right away. Make no mistake; however, Bitcoin should be used as a currency - and NOT an "investment" or fund raising tool - it has no guarantee past the second you buy it - it may climb or fall in value, and the fact everyone is trying to use it as an investment simply makes it's value even more volital. But we are going to tell you some things below about Bitcoin to think about. See especially http://www.latimes.com/business/hiltzik/la-fi-hiltzik-bitcoin-price-201… and https://www.cnbc.com/2017/09/05/bitcoin-dips-another-200-after-chinas-c….

Bitcoin is a dumb investment, risky and only good for cash transactions for items from vendors who might not accept traditional bankcards like VISA and MC. Most importantly see https://www.washingtonpost.com/news/innovations/wp/2016/01/19/r-i-p-bit… - but that does not mean it is not a good fast way to send a cash equivalent and that is all we are intereted in here to sell an item. For how it works in layman's terms see https://www.economist.com/news/briefing/21677228-technology-behind-bitc…. Buy what you need - make a purchase and get out - or leave only as much as you are willing to loose. Here is a reasson why => http://www.marketwatch.com/story/bitcoin-ether-and-other-cryptocurrenci… and https://www.forbes.com/sites/laurashin/2016/12/20/hackers-have-stolen-m…

Bitcoin has been such a roaring non-regulated success it is going to change world currency and soon the US Dollar itself will likely also change. See http://www.nasdaq.com/article/fedcoin-could-replace-the-dollar-as-we-kno... and https://themerkle.com/what-is-fedcoin/ Some countries are adopting and regulating Bitcoin - like Australia and the UK are working on plans and laws to do so - and Japan is adopting Bitcoin as a tradable currency in as many as 230,000 local shops. See also http://moneywise411.com/tbo-awards-7-billion-to-develop-new-fedcoin/

Bitcoin however is really just a money transfer system - no different than Western Union or Money Gram that is free of currency exchanges and can be much cheaper than those company fees for large amounts;; however many people saw it as an "investment" - and it is NOT.

It may "LOOK" like an investment because of what other people might be willing to pay for it and its alleged anonymity . But these people are feeding a "pyramid scheme" mentality. 7 billion people in the world and maybe 10 million bitcoin holders means - it makes for a HUGE pyramid.base After all - because it is money transfer system - you are actualy just "buying" the money transfer service - so it is NOT an "illegal" pyramid - but as an investment mentality - it IS a pyramid, because one is "buying" into the "notion" that someone will be willing to buy the bitcoin for a greater amount than the pother person paid for it.

Because Bitcoin is an anonymous worldwide money transfer service that can be made to look - like - and indeed others are paying more money - for it than someone else paid - it "LOOKS"like an investment - and the trick is to sell it while someone else has paid way to much for it. It is a bamboozle - shell game - a slight of hand - for the "mark" who has been tricked into believing it is a fast buck for free. See https://news.Bitcoin.com/markets-update-major-crypto-markets-dump-uniso… - let it be said it was the bitcoin exchanges who were artfully and artificially inflating the prices in the first place. Their game was to sell it for a mark up above what Bitcoin was actually trading at - making it appear Bitcoin was going up in value - becasue they were inflating the price - and there were plenty of "suckers" tempted to buy into it - and lots of people did.

Let us look at this in "perspective" -- there was a popular self collapsing Pyramid scheme called "the airplane". it consisted of a "Pilot", two "Co-pilots", four "Crew members" and eight "Passenger" seats which were available le purchase - at usually $1,500 each.

The job of all people on the "airplane" was to sell "tickets" at $1,500 to fill all eight seats and at which time - the "Pilot" who actually collected all the ticket fees - was paid a total of $12,000 for all the Passengers, the airplane "split" into two "new" airplanes - the two co-pilots became "Pilots" of their own "airplane", and the process completed AGAIN until the new "co-pilot" - now - "pilots" were paid $12,000 and it split again until eventually the passengers rose also to the top and collected $12,000,

The only problem is this was an illegal scheme because there was no actual "airplane" that traveled anywhere and hence there was no "product" because the "tickets" while could be sold to anyone dumb enough to buy one higher up at a larger price from a crew member or co-pilot to take their place for more money to get paid quicker the "$12,000"; it was all just a modified illegal pyramid scheme.

An "airplane" was said to "stall" and then "crash" if those persons in the scheme could not locate new "marks" to sell tickets to. At that point persons on the airplane were willing to sell there ticket slot - for less than they paid to just get some money back and get out. This is what is happening to Bitcoin - at Christmas 2017. Bitcoin will wear this "black eye" of truth forever.

Be clear - however that Bitcoin is not "illegal" when used as a money transfer service like MasterCard or Visa - to move money electronically to a vendor selling an item - it is just that the vendor or merchant may take a risk that the value of Bitcoin they accepted as payment does not plummet before they can sell it into real money of their currency to ship a product.

At Christmas 2017 - now Bitcoin is plummeting so fast not even a vendor would want to accept it - because surely they will loose money before they can turn it back into "real" money again. Also the question is today - IF - they can sell it at all. Bitcoin was born electronically - and is priced and traded electronically - and so there are places around the world where even just the currency exchange rate makes it advantageous to use - to by-pass a weak currency and turn it into a stronger currency in some other country.

That also made it attractive as an "investment" appearing vehicle or system. It is way cheaper for a merchant to use than MasterCard or Visa and even Western Union and Money Gram - and more convenient to both parties - especially for large transactions - assuming the Merchant can sell it right away. Then the reality is the Bitcoin Achilles heel is the "miners" who are rewarded in "Bitcoin" for just processing the transactions - and they have every incentive to dump it as fast as possible as it is falling in value. Lastly the bitcoin thieves do not make things any better. See https://nypost.com/2017/12/16/north-koreas-stolen-bitcoins-now-worth-mo…; or "google" search => Korea bitcoin stolen 80 million as terms

So . . . we say - buy bitcoin - buy something with it - and get out of it. You could gain - or you could loose if you "hold" it.

The price of bitcoin changes by the second - like the stock market - and sellers often mark up the average price to their price. You should watch the trend - using the price at https://www.coindesk.com/price/ and try to catch it at a low and / or a fresh short upturn from a low.

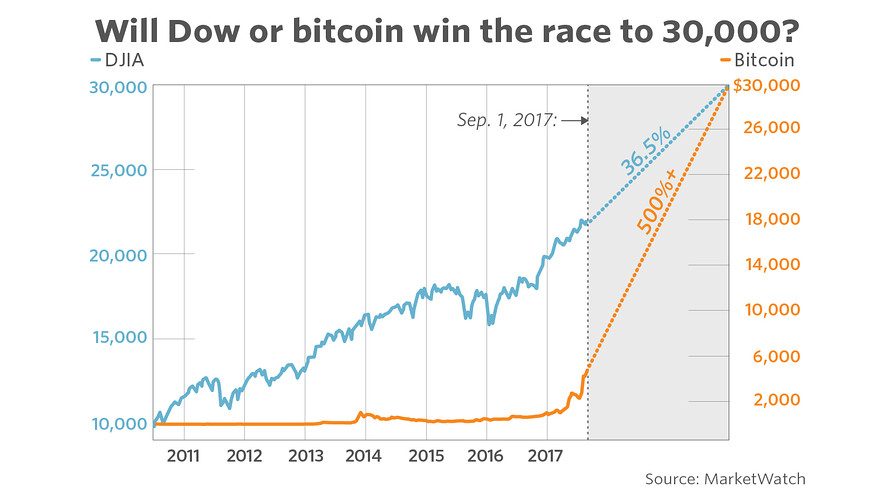

See http://www.marketwatch.com/story/what-will-we-see-first-dow-30000-or-bi…

For pricing trends and charts you can manipulate visit https://www.coindesk.com/price/ and / or https://bitcoinaverage.com/en/bitcoin-price/btc-to-usd - and you can see the different prices even between two exchanges reporting in real time. The exchange which often reports the highest price - and will thus pay you the highest is https://cex.io/ . BUT . . . buying Bitcoin there will also COST you the most there. So the smart person sells there - but does not buy Bitcoin there. On average https://cex.io/ reports rates higher than Coinbase by about 1% but still that is an extra 1% you would not have if you sold your Bitcoin elsewhere.

Here is an example. cex.io showed a Bitcoin price of $4469.00, Coinbase showed $4369.00 and Coindesk/price showed $4319.00 all at the same time - while https://coinmama.com a seller only - showed approx $4640 ($4639.95) - so their price is marked up around $200 and if you buy there - there is that PLUS a surprise $10 service fee after you complete the entire order process and have reached the last step to pay. Here is an interesting fact - cex.io does not make it clear how to transfer in Bitcoin bought or received elsewhere. If you move bitcoin there and sell it bought at a lower price elsewhere or received in a sale of some item it is the smartest move.

Here is how cex.io does it:

************

Thi service, provided by CEX.IO, simplifies buying and selling on the exchange, and is based on Fill-or-Kill (FOK) orders.

FOK orders are executed immediately and in full or are not executed at all.

In other words, with FOK orders, CEX.IO guarantees that its users will receive not less than the agreed amount of cryptocurrency for the agreed price.

How does it work?

CEX.IO calculates the price and freezes it for 120 seconds. The service exchange rate is adjusted to mitigate the risks connected with price fluctuations.

At any given moment, you input the amount of money you wish to spend and you see the amount of cryptocurrency you can receive, according to the service exchange rate, or vice versa.

After you press the Buy/Sell Button, the system checks your available funds; if you have enough, you are asked to confirm the trade.

If the situation on the market allows the execution of your order on conditions not worse than you agreed on, the order will be filled. (The order can also be filled on more favourable conditions.)

If there is a sudden spike in the exchange rate — preventing the execution of the order on the agreed conditions — you will be notified upon the submission of the order.

After you confirm the trade, your order is matched to other orders on the exchange, and your balance is adjusted — sometimes the amount can be even greater than agreed on, but is never smaller.

What is the fee for this service?

CEX.IO takes a 7% fee for the service which is charged from the amount of fiat currency.

***************

But . .

CEX.io does NOT support the following US states at this writing as of late August 2017):

Alabama, Alaska, Arizona, Arkansas, Colorado, Florida, Georgia, Guam, Idaho, Iowa, Kansas, Louisiana, Maryland, Michigan, Mississippi, Nebraska, New Hampshire, New Jersey, North Carolina, North Dakota, Ohio, Oregon, Tennessee, Texas, U.S. Virgin Islands, Vermont, Virginia, Washington. For more info see https://www.buybitcoinworldwide.com/exchanges/cex-io/

CEX.io does have the lowest purchase fees - but remember sports one of the highest quote rate.

Bitcoin is actually an investment that that has been climbing steadily - so if you purchase something from us by bitcoin, your residual "funds" or "change" from your purchase - is likely to even grow and eventually cover your cost of the item. Bitcoin has been climbing at about 5 to 7 percent PER DAY, and that is a great investment return.

Prior Coinbase product manager and now Runa Capital principal, Nick Tomaino, says ""The shift right now is around money. So, the biggest example is bitcoin. Fundamentally, what's interesting about bitcoin is the ability to shift the control of money from centralized institutions to people,"

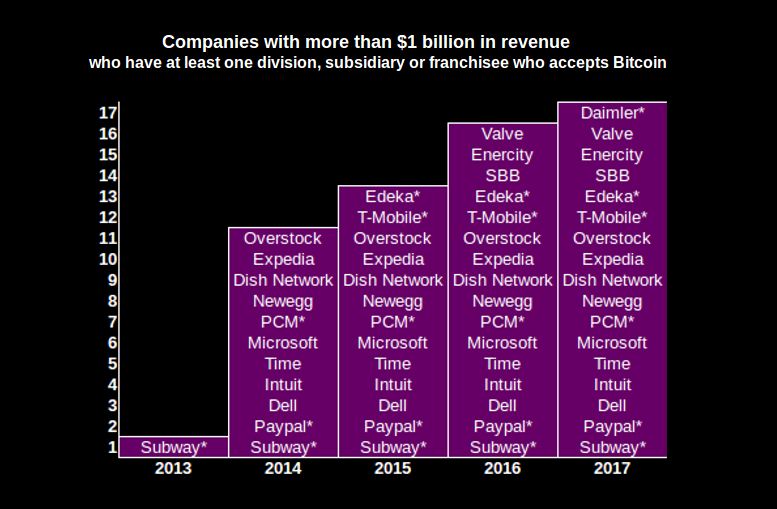

The major thing holding Bitcoin back is that it cannot process transactions FAST. It is the ONLY digital currency which has websites that accept it and even an ATM network - at least in the US - where you can buy it. BUT . . . it is also subject to regulation whenever and if any government decides to do that. For instance China created law that merchants cannot accept it as currency in payment. On the flip side Japan and Russia see it as a national wealth builder and control mechanism - see https://www.cnbc.com/2017/04/12/bitcoin-price-rises-japan-russia-regula… - and Australia and the UK are not far behind. The UK let a cyrtpocurrency contract to Circle.com for development in April 2016. Right now, Bitcoin is best for large "cash" type transactions outside of the credit card networks, which does not make VISA or MasterCard happy - but even they are trying to get in on it with "prepaid" credit card adoptions to Bitcoin. Others are trying to use it as an investment, but still . . .

The other thing holding Bitcoin back is businesses have no way to accept it easily without being tied to some one other entity that is onerous - and no reliable "lightweight" web software exists to let online merchants accept it; and, for the solutions out there right now - that can convert the Bitcoin payment to cash - like USD - there are costs like a pre-paid debit card that charges for everything from obtaining it to even loading it - to using it. Then if one is doing this independently - the issue is whether to sell the Bitcoin right away or hold it as it may appreciate after the sale. Right now - in September 2017 to set up a Bitcoin server occupies around 300 GB of hard drive space, It will need more as the blockchain grows. The Bitcoin server code hits a CPU core (or cores) pretty hard - unless you limit it at the CPU - and invites every hacker in the world to try to break in to your server. Within 12 hours of activating our bitcoin server - we had over 59,000 attempted unauthorized logins - so running a Bitcoin server is not for the faint at heart - and the server had not even fully downloaded the full blockchain yet - before we took it down for a lighter weight partial blockchain software option. And finally - and worst of all - Bitcoin software seems to have no support from its authors at all - and is poorly documented if at all. so one needs to be able to read "code" and understand flow of someone else's programming logic as well as teh language it is written in. . The Bitcoin software authors are open source programmers - and release their code for free and generally do not answer emails about issues of their software creations.

Still Bitcoin has the investment world "baffled". One person called it a "pyramid scheme"; => see http://fortune.com/2017/07/27/howard-marks-bitcoin-pyramid-scheme/ => but he does not understand his own craft. A pyramid scheme has no product. The "product" is a variable rate (appreciating or depreciating) world currency that cannot be counterfeited which can be spent or saved in its issued format by a public ledger email system. One could argue Bitcoin is not a "product" - and technically in hard form terms it is not - it is the result of supporting bitcoin which is the "product". The virtual currency - bitcoin - relies on "mining" computers that validate blocks of transactions by competing to solve mathematical puzzles - of an algorithm - every 10 minutes. The first to solve the puzzle and clear the transaction is rewarded with new bitcoins. That "payment" is what keeps the product growing - because what it is - is an unregulated barter system that gives even the participant growing value for their participation and - after they use some bitcoin - it is likely to further increase in value and reduce the price of their purchase even more.

Everyone is trying to "invest" in Bitcoin to make money on it instead of using it - because you really cannot use it at most places. That will not fare well for Bitcoin in the long run.

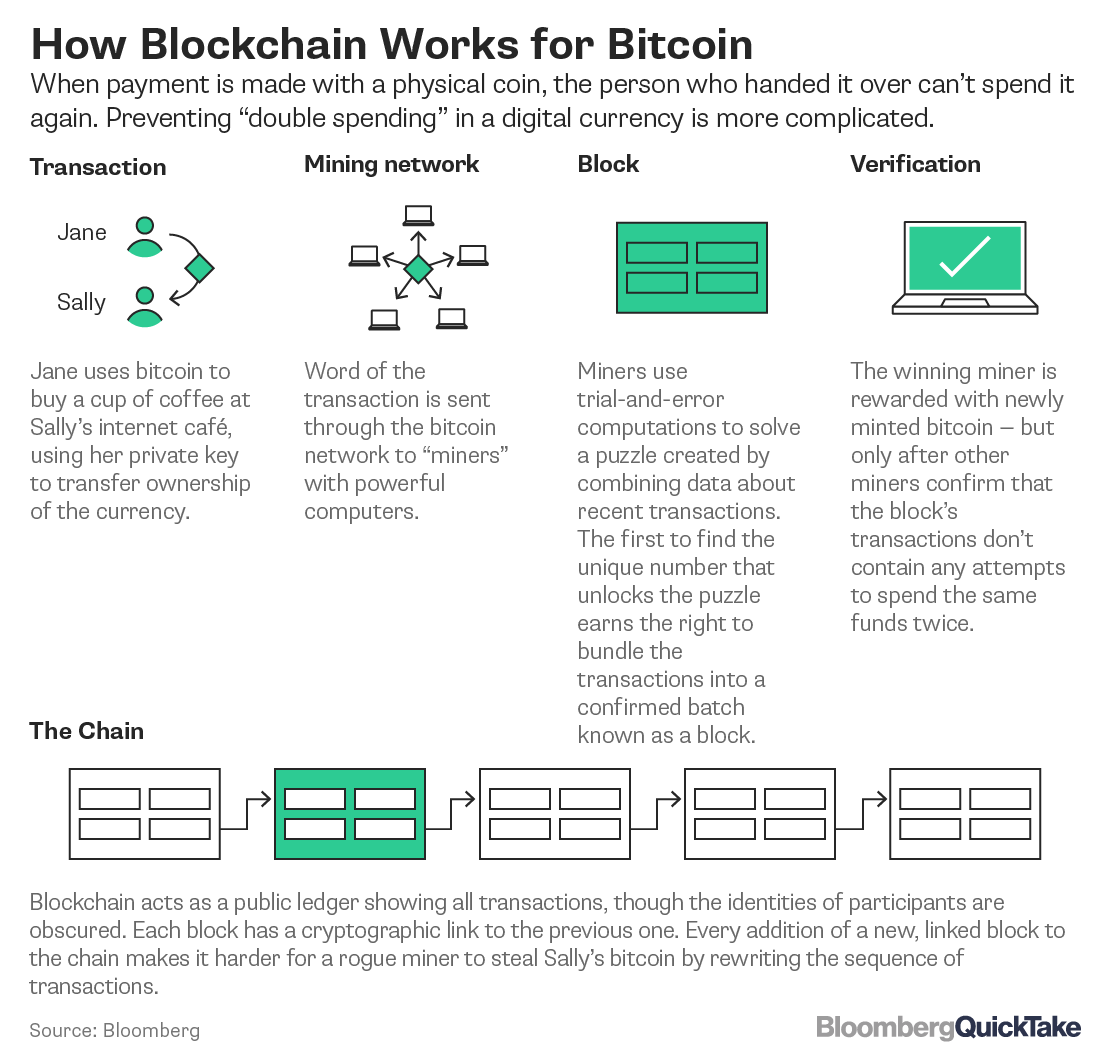

One thing everyone seem to agree on is the genius of the blockchain technology of a distributed public ledger that makes transaction just about impossible to counterfeit - Bitcoin is based on.

Others have said "bitcoin needs to become a "real currency" => see https://finance.yahoo.com/news/bitcoin-needs-become-real-currency-13483… and what a joke that is to even suggest. It shows the author does not know that the value of the market is what backs Bitcoin. As long a people are willing to pay for an anonymous world currency that will only appreciate with its use as more people buy in - then it is the stock market, a derivative, and a world currency that cannot be counterfeited all rolled into one. If Bitcoin were to become a "real currency" counterfeiting would be possible. There exist Bitcoin "paper wallets" which come as close to a many of a tangible currency as one wants to get - and many wise people would no ver trust the paper "QR code" paper versions of bitcoin - because until they are validated - they have no value but to a fool who would accept them without digital verification. Remember when Bank accounts made "interest" - why should not your money do the same outside of a Bank? In fact some financial institutions ARE investing in bitcoin and using that return to pay interest or dividends - minus - their cut of course to investors and clients.

Bitcoin's other large problem is the powerful mining and processing nodes are all in Asia - China mostly, and that has Wall Street "lukewarm" to it and quietly they do not say so - but that is the real rub. It takes a lot of processing power and thus - lots of electricity to run power hungry super processing nodes required for mining Bitcoin transactions to process them. However for the REAL and total rundown on what is going on in the world of money visit this link and watch the entire video - it is very interesting. See https://secure.caseyresearch.com/chain?cid=MKT336710&eid=MKT337276&encr… it might frighten you and no this is not meant to promote caseyresearch

Here is an article that PROVES what Bitcoin is - as a wise investment and currency of use. https://www.wired.com/2017/01/bitcoin-will-never-currency-something-way… Their is a guy in the article who left Coinbase to start his own venture capital firm based on digital currency. Digital currency scares he hell out of investment bankers and stock market types because it will destroy the current currency system world, because they all forget about the computers we carry called "smart phones" and the ability of most all retailers to accept Bitcoin should they choose to - like Overstock.com and we at bigbay4bestbuys already do. It is a way to sell products with less overhead and issues.

Bitcoin is the world making the rest of the world more wealthy - but of course if you are not in the digital age you get left behind - just like the stock markets have always done to anyone who cannot invest their time or garner the wisdom in figuring out what to buy or not buy. But Bitcoin does not require than kind of smarts - just for you to ride the wave and be smart enough to get on in it "somewhere" in the first place. You can spend $65.00 on a tank of gas in the US - and you will burn it up driving around - and it is $65 gone - or your buy $65 worth of bitcoin. You can buy bitcoin and wait for it to increase in value and then sell it or buy more; or put up a full node server under any internat web server - that you can also use as a web server for sales of some product or purpose - that is a powerful enough computer and do mining. The choice is yours and the sky is the limit to the 7.442 billion people in the world at this writing in August 2016 against the estimates that more than 10 million people around the world hold a material amount of bitcoin. The estimate is based on Coinbase user activity when applied to the overall Bitcoin community. There is thus a huge amount of room for growth there in Bitcoin participants and activity.

clicking on image should enlarge it in a new window

see https://www.bloomberg.com/quicktake/bitcoins for the full article on the issue

Bitcoin's value against the dollar has nearly tripled this year - 2017 as of August - as public interest in digital currencies has spread. It remains highly volatile though, losing some 30% in just over a month between June and July due to a dispute over how to help its underlying technology adapt to the sharp increase in demand for it. It also continues to be dogged by associations with illegal activities. around July 6, 2017 with levels just under $2,600, it was at about 12% below its all-time high against the dollar. But its stellar gains – it's up over 900% in the last two years against the dollar – mean that early backers have been able to sell their investments at huge profits to later investors who, in many cases, have little understanding of what they're investing in. As of Mid-August when this was written - it is now over $4,000 and climbing.

No investment in any company that produces a hard product can match that. Early adopters are getting wealthy, and later investors are all gaining wealth - and it is because Bitcoin's value is driven by how people are willing to actually pay to get into the currency. And that is the key - Bitcoin is the leading "world currency" free of International borders.

The Federal reserve then "validated" the digital currency technology going on record as interested in actually issuing a digital currency as US funds - dubbed "Fedcoin" - and price movements in blockchain-based cryptocurrencies as influenced by the ultra-easy monetary policies put in place by central banks after the 2007-2009 global financial crisis.

But sharp price gains in cryptocurrencies may be a sign of excess and have led some investors to call the market a bubble.

Investment "wizards" and their colleagues have been advising clients to stay invested in global stocks even as some other strategists warn that prices are overextended after a run-up over the better part of the last decade. the problem they see is that no company can match what Bitcoin is doing - as fast - and they cannot regulate it - or get a hold on it to even try to regulate it. Others have recognized "a this point, the time has come to finally declare that bitcoin and other cryptocurrencies should be considered investment options for investors.

Chris Burniske of ARK Investment Management, and Adam White of Coinbase recently wrote a white paper that takes this view of bitcoin and other cryptocurrencies. See http://www.marketwatch.com/story/bitcoins-are-the-best-investment-in-my…

Bitcoin, the primary cryptocurrency, hit a point just shy of $3,000 in June 2017 but then had fallen some 20 percent since then, trading at $2,366 on July 12, 2017. Over the last year, bitcoin is still up 264 percent. At this writing mid August 2017 - August 13, 2017 it is trading at over the $4,000 mark and climbing.

Competing cryptocurrencies, such as ethereum and litecoin, posted quadruple-digit percentage gains ahead of losses in recent days.

Bitcoin is the leading currency because it has a developed acquisition, way to spend it as a competing currency; and sales network that uses an email system spread out to so many computers nothing short of a huge solar flare that shuts down all electronic operations on the planet can stop it A person could invest just $65 in Bitcoin and in less than two days - let alone - weeks recover their investment and purchase fees and then watch their money grow - as Bitcoin. Certainly it is not for the faint of heart - and / or unwise who cannot analyze what they are buying for and paying for (as fees can be a surprise as hight as 25% to buy bitcoin) or keep a computer running properly - but then that is "life" in the digital age. Basketball and general Sports knowledge will not help you here.

Some investors have warmed to the technology, wooed by its explosive performance and the potential that the currency compete with gold and government-issued money as a store of value. Some also see other potential uses for blockchain, the technology that documents and verifies bitcoin transactions. Bitcoin iis people investing in the spending habits of other people and entities.

According to Peter Smith, Blockchain CEO/co-founder, and Jeremy Liew, Snapchat’s first investor, Bitcoin’s price could hit $500,000 by 2030. The pair made their case for this projection to Business Insider. Remittance transfers are one reason. Bitcoin transfers to foreign countries have nearly doubled in the past 15 years and account for 0.75% of GDP, according to the World Bank; and it is highly likely bitcoin-based remittances will increase sharply as awareness builds.

Also the more people talk about Bitcoin - the faster it will grow. As the saying goes - any publicity is good publicity. The cell phone boom is going to be one of the major reasons the Bitcoin boom will explode. We as humans now carry around computers today that have way more power than the Apollo mission that went to the moon - and well call them "smart phones". They are "smart phones" and run a variant of Unix - called Linux - we know as "Android"or "IOS".

Consider the following "what if" scenario:

- A $1,000 bitcoin price in 2017 - but is already over $4,000 near $5,000. Hmmmm

- The Bitcoin user network will grow 61 times through 2030. A population of Bitcoin users comprising 5% of the world’s population in 2030 will drive the price to $500,000 in 2030. From 2013 to 2017, the network grew from 120,000 users to 6.5 million users, nearly a 54-fold gain. Such growth would produce 400 million users in 2030.

- The average bitcoin value per user will hit $25,000. When institutional investors cash in their bitcoins, bitcoin-based ETFs and trading by sophisticated investors will increase, pushing the average value to $25,000. With a current market cap of $17.4 billion and 6.5 million users, the average user now holds $2,515 of bitcoin.

- The 2030 market cap is based on the number of bitcoin holders multiplied by the average held bitcoin value.

- The cryptocurrency’s 2030 supply will be about 20 million.

- The 2030 price and user count will total $500,000 and 400 million, respectively. The price is determined by taking the $10 trillion market cap and dividing it by 20 million bitcoins, the fixed supply.

Here is the thing no one is thinking about - this is "World" currency - and while there are "copy-cats" - Bitcoin as the first - is actually the "universal digital currency" that cannot b e "counterfeited".

In short people are getting into Bitcoin - at higher prices after just learning about Bitcoin and that keeps the price rising as they are willing to pay whatever the price is at that moment to "get in".

But still there has been a lot of negative news about bitcoin recently.

China, where most bitcoin trading takes place, has tried to crack down on "open commercial" trading. The three largest bitcoin exchanges have announced a 0.2% fee on all transactions, as well as blocking withdrawals from trading accounts, but a new way has emerged, see https://www.wired.com/2014/01/huobi/ - as a new Bitcoin King emerged in China after the bitcoin crackdown.

The U.S. Securities and Exchange Commission (SEC) rejected two bitcoin ETFs. Another proposed ETF is not expected to be approved.

But bitcoin is in its early stages. He said the SEC ruling was not a surprise. Winning such approval could take a long time. the problem is Bitcoin will wipe so much other investing to the "side lines".

Meanwhile, regulatory approval has occurred elsewhere. Bitcoin became legal payment in Japan on April 1, 2017.

Another obstacle is the hard fork, which could cause a split into two bitcoins, regular bitcoin and Bitcoin Unlimited, and when that happened July 16, 2017 the price of bitcoin did drop to one of its lowest lows of around $1,900 - then took off again as wise investors saw it as the opportunity to "double down". After all if you bought bitcoin at $1,500 and had seen it as high as $3,000 just five days before on July 11, 2017, you know the interest and investors are there and after the "scare" of the "fork" and people realise the copy-cats cannot complete as broadly as Bitcoin has spread - you can see they were right - at right now it is at $4,000 plus and climbing.

Smith is not concerned about the hard fork since there are strong economic incentives to prevent it. He noted that the bitcoin blockchain has operated for more than seven years with no downtime, which no other back-end system operating at the same scale has accomplished.

While the price of bitcoin has been volatile compared to traditional currencies, it has always rallied. After rising 20% in the first week of 2017, it crashed 35% when China cracked down on trading. Since, then, it has recovered those losses and is up 25% for the year.

After all China just pushed the activity "under ground"; and it is still going on by "proxy" traders. See again https://www.wired.com/2014/01/huobi/ In 2013, they effectively prohibited all Chinese businesses from accepting bitcoins after the currency surged in popularity. Their government is not elected, nor accountable, with central planning leading to ghost towns and ghost factories due to no consultation with the public as to what is desired or needed. China is after a hotbed for bitcoin mining and the government will not stop bitcoin. We always hear about "chinese hackers" - they are - and always have been - good at numerical stuff. The abacus is and always has been a widely used tool in China leading to well counting thought in brain power. See https://www.buybitcoinworldwide.com/mining/china/

The Chinese are resourceful like people anywhere - and people can use virtual private networks to access it anyway. Also, plenty of trading happens on lesser-known sites and on micro-messaging services such as WeChat and QQ. The latter already have their own payment systems, allowing users to build chatbots to automate trading activity. For those who prefer a more familiar trading interface, decentralized exchange software such as Bitsquare can construct an order book based on outstanding offers accumulated from other participants.

China is not alone. Peer-to-peer trading took off in Turkey after the country’s only bitcoin exchange ceased to operate, and in Venezuela after the leading exchange had its bank account closed. Russia has some of the most active unofficial bitcoin markets in the world, thanks to the country’s longstanding regulatory uncertainty.

Even if a government shuts down every bitcoin node in its country, a bitcoin user can still transact as long as a single node is accessible overseas. People open bank accounts or declare citizenship in a country where they can "buy" citizenship - and there are quite few places on can buy citizenship and passport from that country. For instance CoinCorner allow purchases with credit and debit cards for verified users, from many countries - and they list their supported Countries, but also state "Citizens and resident aliens of the United States of America and other such unsupported countries are not eligible to register to use CoinCorner whilst resident in the unsupported country and or if they are temporarily or permanently resident in an accessible country. Notwithstanding if their income is not subject to the tax of an unsupported country." This means one needs to pay tax in a supported country it appears to be eligible. Any smart person would have no problem with that.

Bitcoin will be a resource of the "clever"; and when it comes to one's livelihood and success - if you reside somewhere your success is limited or capped - anyone with half a brain will find a way out of that - it is called being a "refugee" - and it has been fuelling immigration and people to move from conflict zones for as long as man can remember - so bitcoin will not stop them - it will facilitate and empower them.

| Attachment | Size |

|---|---|

| bitcoin_climb.png | 54.7 KB |

| blockchain.png | 86.19 KB |

| download.gif | 2.32 KB |

| bicoin_dow.jpg | 66.49 KB |

| accepts_bitcoin.png | 137.64 KB |

,

,  ,

,

,

,  ,

,  ,

,  ,

,  ,

,  ,

,

,

,

,

,  ,

,  ,

,

,

,

,

,  ,

,

,

,  ,

,

,

,  ,

,  ,

,  ,

,

,

,  ,

,  ,

,

,

,  ,

,  ,

,

,

,  ,

,

,

,  ,

,  ,

,  ,

,  ,

,

,

,  ,

,  ,

,  ,

,

,

,  ,

,

,

,  ,

,  ,

,