TransOcean's Deep Water Horizon crew & BP Knew Better.

Has everyone lost their minds? All this business about the oil industry in general is just "Monkey crap" given that we could be using sea water directly as fuel in th form of Hydrogen which would return back to Earth as beneficial rain - precipitation to clean and cool the planet and could use also both polluted and sewage waters in an efficient way to power mankind fueling needs. To lease a rig for over $20,000 hour to drill for oil, to pollute and warm the planet is just monkey crap. People who still think like the wild apes - no wait - the apes probably have better sense..

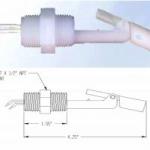

(Pic below is a rig similar to the Deep Water Horizon on the "Mighty Servant" - a transport ship for semi-summerible floating drilling platforms.

Ironically this vessel sunk in 203 feet of water off loading this platform - and it was recovered and put back into service. See https://gcaptain.com/mighty-servant-3-sinks/

There was a drilling mishap - yes. It seems it took a Youtube video to get BP to get the well under control, then NBC Universal complained as a copyright owner of the mocie from which is came - "Hellfighters" - so eventually on October 16, 2012 it had to be taken down after being blocked worldwide.

It was an excerpt from the Movie "Hellfighters" staring John Wayne about the then legendary Red Adair, the guy who perfected blowing out oil well fires with explosives and then capping the wells. The only difference here was there was no fire, and the well was a mile down in water.

Posted two weeks before they did EXACTLY this the video above shows, now does someone have tell them you do not try to cap a high pressure bottle you know has value.

What we should have done was put the well into production and bleed the reservoir dry - anyone knows at 24 million barrels of oil per day America's consumption of energy does not mean entombing a perfectly good source of oil.

This drilling accident is a result of America's voracious appetite for oil consumption and the serious need for local sources of oil. It illustrates why we need to move the entire country to on-the-fly fueled Hydrogen powering.

As of May 10, 2010, BP says it has spent 350 million dollars and counting. There goes cheap ARCO - gasoline. ARCO - Atlantic Richfield COmpany, is a subsidiary of British Petroleum.

The pocket that BP was drilling to they knew was going to be a high pressure well. They suspected it would be (and hoped it would be) sweet crude and a large reserve of it.

The pressures that they were dealing with out there, drilling deeper, deeper water, deeper overall volume of the whole vessel itself, pushes pressures dealing with 30 to 40 thousand pounds per square inch range -- serious pressures.

The oil emanating from the seafloor contains about 40 percent methane, compared with about 5 percent found in typical oil deposits, said John Kessler, a Texas A&M University oceanographer who is studying the impact of methane from the spill. That is what in part made this a high pressure well.

This well is 3 miles deep. It is three miles down below the bottom of sea floor which is 1 mile of water itself. Water at 40 degrees at that depth makes CRUDE oil - which comes out of the Earth normally warm - literally freeze. For those who live in freezing climates - you know what trying to run "straight weight" motor oil does when you try to start your engine at even 40 degrees - it is like molasses. . . .

(This is why they are now finding most of the oil has NOT surfaced and is a PLUME hanging in mid-ocean below the surface)

AND . . . that depends on who you ask . . . BP’s federal permits allowed the company to drill up to 20,000 feet deep, but according to one of the workers who was onboard the rig during the explosion, drilling in excess of 22,000 feet had been taking place. This same worker is said to handle company records for BP, but BP has denied these allegations. Maybe this guy meant 17,000 feet of actual well depth. plus the 5,000 feet of water - for 22,000? Even BP's PDF of attempted repairs shows a well close to $20,000 feet. See http://www.bp.com/assets/bp_internet/globalbp/globalbp_uk_english/incide... (right click and open in new window or tab)

Of course then there are others who have said others [Louisiana lawyer Daniel Becnel Jr.] told them that one of the platform workers has informed him that the BP well was apparently deeper than the 18,000 feet depth reported. BP/TransOcean allegedly failed to communicate that additional depth to Halliburton crews, who, therefore, poured in too small a cement cap for the additional pressure caused by the extra depth. So, it blew.

Why didn't Halliburton check? "Gross negligence on everyone's part," said Becnel.

The reality is they were drilling into a hot deep reservoir of oil and gas and did not take every precaution possible. TransOcean is a contractor who owns(ed) the DeepWater Horizon and they wanted to get the well off there hands into the clients so they could move their equipment on to the next client.

Here is how a guy who was actually on the rig when it blew explained it:

begin rig worker narrative

""We had set the bottom cement plug for the inner casing string, which was the production liner for the well, and had set what's called a seal assembly on the top of the well. At that point, the BOP stack that he was talking about, the blow out preventer was tested. I don't know the results of that test; however, it must have passed because at that point they elected to displace the risers -- the marine riser from the vessel to the sea floor. They displaced the mud out of the riser preparing to unlatch from the well two days later and they displaced it with sea water. When they concluded the BOP stack test and the inner liner, they concluded everything was good.

Alright, after the conclusion of the test, they simply opened the BOP stack back up.

Next step, they opened the annular, the upper part of the BOP stack, so that you can gain access back to the wellbore.

When you close the stack, it's basically a humongous hydraulic valve that closes off everything from below and above. It's like a gate valve on the sea floor.

Once they open that plug to go ahead and start cementing the top of the well (the well bore), we cement the top, and then basically we would pull off. Another rig would slide over and do the rest of the completions work. When they opened the well is when the gas well kicked, and we took a humongous gas bubble kick up through the well bore. It literally pushed the sea water all the way to the crown of the rig, which is about 240 feet in the air."" [so gas got into it and blew the top off of it.]

end rig worker narrative

Here's how the Miami Herald in part largely reported it:

""At 9:53 p.m. April 20, the Deepwater Horizon's luck played out. A shrill blast of escaping gas and a geyser of black goo hurled high over the placid Gulf heralded its demise, and in minutes the $560 million giant vanished into a fireball that was visible far over the horizon.

In contrast to its swashbuckling past, the Deepwater Horizon's last day was one of frustration, cascading problems and, ultimately, calamity.

By 1 a.m. on April 20, workers had finished injecting cement into the four-mile-deep well they'd drilled to strengthen the sides and protect the pipe. It needed time to set, and then they'd test it.

During the previous weeks, the well had been troublesome. Pressure from the reservoir of oil and natural gas 18,000 feet beneath the Gulf floor was kicking at the pipe, and the Deepwater Horizon had been venting with loud huffs.

Commissioned in 2001, the Deepwater Horizon was in the vanguard of new drilling ships that are able to burrow deeper than ever before.

Its 2009 oil find, in a fist of ancient rock laid down in the epoch of dinosaurs and called the Lower Tertiary Trend, required it to drill 31,000 feet - one of the deepest wells in the world, deeper than Mount Everest is tall.

With such reach, it opened new exploration vistas for BP, which paid $20,312 an hour to lease it from its Swiss owner, Transocean Ltd.

After celebrating and cashing their bonuses from their big find, the Deepwater Horizon's crew learned that the rig was getting a new assignment.

Its prospecting days were over, and the Deepwater Horizon was to become a production platform, squatting semi-permanently over an oil dome 50 miles off the coast of Louisiana. BP hadn't announced the find, but it was thought to be huge.

At 8:20 a.m. on April 20, the workboat Damon B. Bankston arrived at the Deepwater Horizon, which it had been tending for two years. Its mission this day was to take drilling mud from the rig for recycling.

Crewmen attached a hose to the Bankston, and at 1:17 p.m., slurry began flowing between the vessels. At 5:17 p.m., it stopped, and the Bankston was told to stand by for more.

At least three times during the day, the crewmen aboard the Bankston were startled by sudden loud noises as bursts of pressure were released from the rig.

At about 5 p.m., the pressure tests were done on the newly cemented well. Something was wrong.

First, a test signaled that gas might have been leaking into the well. Another test found a "disturbing pressure imbalance."

Gordon Jones, 28, was a mud man on the Deepwater Horizon. A graduate of Louisiana State University, he was one of two specialists from M-I Swaco aboard the rig to advise BP about "mud."

Despite its indecorous name, drilling mud is a complex concoction of clay, minerals and other additives that keeps the drill lubricated and carries shavings back up to the rig. Its recipe depends on what kinds of surfaces the drill bit is chewing; one blend even uses diesel oil.

It's pricey, too. A bore such as the one the Deepwater Horizon had drilled would run up a mud bill of $10 million or more.

Mud is also the main line of defense against blowouts. It plugs the pipe and resists the massive pressure of gas and oil.

Though he wasn't scheduled to start his 12-hour shift until midnight, Jones went to the mud room about 9 p.m., told his M-I Swaco counterpart that he looked tired and offered to take over. His offer was accepted gratefully.

Jones, who'd been working aboard the Deepwater Horizon for two years, was on the third day of a weeklong shift. He'd be off for the next seven weeks.

His wife, Michelle, was eight months pregnant with their second child. He'd arranged time off to be with the baby.

This wasn't going to be a demanding rotation. With the well in its final stages of preparation, there was little need for new mud.

"Gordon said he was going out there to sit on his butt," recalled his father, Keith Jones, a Baton Rouge lawyer, who said he never worried much about the dangers aboard the rig.

"Honestly, what we worried about," he said, "was the ride in the helicopter."

It was a clear, calm night, and the smooth, black Gulf glowed with jellyfish. The visibility was 10 miles, and a first-quarter moon was setting.

Despite the pressure problems in the well, engineers decided at about 8 p.m. to resume extracting mud. At 9 p.m., the Bankston was told to stand by for more.

As the operation got under way, the pressure in part of the well spiked to 3,500 pounds per square inch, seven times what it had been before.

Capt. Alwin Landry of the Bankston heard a prolonged hiss of gas, and then mud erupted from the derrick.

"Sort of a black rain," Landry recalled. He'd been mudded before, but it had always been from a broken hose.

He sounded the general alarm to muster off-duty crew, and then radioed the Deepwater Horizon. Trouble with the well, he was told.

"They said to go 500 meters away and stand by. ... I heard the concern in the voice of the operator."

Landry, a captain who'd been supplying drilling rigs for 14 years, had never seen anything quite like this. He ordered the mud hose uncoupled and made ready to move.

A mile below on the seabed, a torrent of gas had seeped into the drill pipe, shot through a malfunctioning blowout preventer and bulldozed through the remaining mud, experts now think.

Paul Erickson, the chief mate aboard the Bankston, had noticed seagulls and egrets swarming the rig lately. Now, with a cloud of heavy gas settling over the rig and a geyser spewing from the derrick, he saw birds falling from the sky like feathery hail.

Gas apparently was seeping into the rig's main engines, too; their mechanical tempo surged as they fed on it.

At 9:53 p.m., two or three minutes after the gas began venting, Landry saw a green flash on the rig's deck, followed by two thunderous concussions. First the main engines ignited, followed seconds later by a blast in the mud room.

The explosions staggered and shocked a small group of BP executives aboard the rig who'd come to salute it for its outstanding safety record.

Spotlights blinked off, and emergency lights snapped on.

"Mayday! Mayday! Mayday!" Landry heard on the radio. "Bridge on fire. Abandon ship."

The Bankston's crew launched a boat to meet life rafts and pick up crewmen, some wearing only their skivvies. A few leaped from the rig's deck into the now-fiery waters of the Gulf.

A ravenous blaze feasted on the rig's many combustibles. Within minutes, the inferno engulfed the tall derrick and clawed into the sky.

Crewmen aboard the rig Helix Q4000, stationed 35 miles southwest of the Deepwater Horizon, gathered at the rail. They could see the firestorm - not just its glow, but the actual fireball - sparkling over the horizon.

By 11 p.m., 115 crewmen from the Deepwater Horizon were huddled aboard the Bankston.

On its wide, flat deck, Bankston engineer Anthony Gervasio overheard survivors speculating about what the gas had done.

"I was sitting around some gentlemen who said that the air blowing off it, because it was so calm out, it accumulated in the engine room, that the engine room had caught fire, blown up," he said.

A defiant fire raged for days aboard the Deepwater Horizon until finally the rig collapsed into the Gulf, where it had made its fortune - and those of its owners and operators - for nine years.

The Coast Guard searched for the next 80 hours by ship and air, but found no trace of the 11 missing crewmen.

Among those lost was mud man Gordon Jones, who'd started his shift early. His colleague, who'd gone back to his quarters early, survived.""

The Miami Herald it seems got to the real story of how they KNEW BETTER - the well was trouble; but TransOcean were contractors and just wanted to get the hell off the well and turn it over to BP.

Mike Miller, chief executive officer and senior well-control supervisor at Safety Boss. Headquartered in Calgary, Alberta, his half-century old Canadian company specializes in fighting oil-well fires, blowouts, pipeline ruptures and processing-facility fires. He’s curious why BP rushed to put out the rig’s fires.

“At least while the rig was burning, all of the effluent from the well was coming to the surface and burning at the surface,” Miller notes. Indeed, burning oil — even on the sea surface — is an accepted spill-mitigation technique. So he’s puzzled why water boats were deployed to dowse the burning platform.

“What they did was fill the rig up with water. At which point it sunk,” Miller says — a full 5,000 feet to the seabed. And that, he maintains, violated “the first rule in offshore fire-fighting, which is not to sink the ship.” The reason: As soon as the rig submerged, it took down the riser pipe, which in this case was a 5,000-foot-long tethered straw through which the oil was gushing up from a reservoir 13,000 feet below the seafloor.

According to Miller, offshore drilling in deep water — anything 1,000 feet and deeper — is a fairly new business. But as most known shallow oil deposits already have been tapped, oil-exploration operations have moved increasingly to more challenging sites. Some offshore wells are being developed to operate from platforms floating almost two miles above the seafloor. “There is a question of doing this now,” Miller argues, “simply because [these deepwater and ultra-deepwater wells] are so difficult to work on when things go wrong.”

At this writing the containment dome they hoped would be able to simply funnel the oil up, clogged with hydrates and even 125 tons of steel was not enough weight, as the pressure of the oil and buoyancy would have simply lifted the huge box off.

Drilling for oil is not simple, safe, nor cheap. The faster you try to do it - the greater the risk for an accident like this. There were 3,858 oil and gas platforms extant in the Gulf of Mexico in 2006 according to NOAA in US Waters.

In this case they knew they were heading for a high pressure well and did not take every safety precaution because they thought all their high technology and regular drilling practices and experience was enough. After all TransOcean is the world's biggest off-shore driller, and here is some of their records.

2004 - Deepwater Nautilus sets its fifth straight world water-depth record for a moored semisubmersible rig. 8,951 feet of water

2004 - Deepwater Horizon sets world water-depth record for a semisubmersible rig. 9,576 feet of water

2005 - Deepwater Nautilus sets world record for deepest offshore oil and gas well. 32,613 feet True Vertical Depth

2005 - Discoverer Spirit sets world record for deepest offshore oil and gas well. 34,189 feet Measured Depth. (about 7 miles of well)

Remember a non-moored semisubmersible - the Deepwater Horizon (now at the bottom of the Ocean) is basically held in place by sophisticated GPS and positioning thrusters while it drills.

Last year BP was granted a special exemption from a legal requirement that it produce a detailed environmental impact study on the possible effects of its Deepwater Horizon drilling operation in the Gulf of Mexico, reported the Washington Post.

Federal documents show that the Department of the Interior's Minerals Management Service (MMS) gave BP a "categorical exclusion" on April 6, 2009 to commence drilling with Deepwater Horizon even though it had not produced the impact study required by a law known as the National Environmental Policy Act (NEPA).

The exemption came less than one month after BP had requested it in a March 10 "exploration plan" submitted to the MMS. The plan said that because a spill was "unlikely," no additional "mitigation measures other than those required by regulation and BP policy will be employed to avoid, diminish or eliminate potential impacts on environmental resources." BP also assured the MMS that any spill would not seriously hurt marine wildlife and that "due to the distance to shore (48 miles) and the response capabilities that would be implemented, no significant adverse impacts are expected."

A year later - they hit oil - and gas - in a big way - and BOOM, to the bottom goes a 750 million dollar drilling rig - that was put in service in 2001 and was a fairly new rig; and 11 lives lost. 350 million dollars in attempted clean-up and containment costs - and not a bit of it sold as any petroleum product - and still counting.

The most conservative estimates now put the Deepwater Horizon spill at about 72,000 barrels and counting. The real figure could already be as high as 350,000 barrels, about 75 times the MMS's worst-case-scenario prediction. In closed-door congressional hearings on Tuesday, BP executives admitted that the well could begin to emit as many as 60,000 barrels, or 2.5 million gallons, a day. At such a pace it would eclipse the size of the Exxon Valdez spill every five days.

As late as March 2010, the MMS approved new deep sea oil drilling operations for another Gulf lease, referred to as "215." The approval cited the safety of other drilling operations, including Deepwater Horizon's Lease 206. (http://www.gomr.mms.gov/PDFs/2010/2010-003.pdf.) [right click and open in new window or tab]

The internal warnings go back as far as 2004. The Wall Street Journal reported the contents of a study, commissioned and reviewed by the MMS that year, which raised serious doubts as to whether blowout protector mechanisms—the equipment that failed to seal the Deepwater Horizon well after its piping ruptured—could even function in the deep sea. The devices were simply untested under such oceanic pressures and temperatures. The study warned that “this grim snapshot illustrates the lack of preparedness in the industry to shear and seal a well with the last line of defense against a blowout” in deep water.

The US Federal Government has since ordered a "30 day review" before new permits are issued, but this is a patently hollow gesture since no new permits are up for consideration in the coming month.

First, the regulatory environment under which these massive offshore structures will operate will change forever. Ask any tanker mate or captain who was at sea in 1990 and is still sailing today as to the downstream ramifications of the EXXON VALDEZ disaster. I can’t tell you what will happen; only that it will involve codifying a whole new set of rules and regulations, based on the exhaustive findings of the investigators.

The political climate which had been slowly inching towards allowing more and more domestic exploration will, at least for a time, stall. Even President Obama, who – much to the chagrin of his most left-wing supporters – had been pragmatic in trying to secure more domestic energy before the whole system bankrupted us, has been forced to back off. (and it has ALREADY Bankrupted the US - we are just in denial) The battles over future energy exploration will therefore only be that much fiercer.

BP pushed through a convincing argument that no environmental impact study was needed so they could get a drilling permit as fast as possible because there was this alleged big reserve of sweet crude in deep water. They had lined up the Deep Water Horizon for contract drilling but needed to get it started ASAP - so the Federal Government - a.k.a the officials of the Obama administration granted it.

Now they are all a bit "peeved". Congressional Democrats are pushing their first legislative response to the Gulf Coast oil spill, proposing to vastly raise the liability cap on companies that are responsible for offshore disasters.

With anger at BP mounting by the day, the legislation has clear populist inspiration and could win expedited passage in Congress, officials say. The bill swiftly earned the backing of House Speaker Nancy Pelosi (D-Calif.) a day after the White House said it “strongly supports” efforts to significantly increase the oil pollution liability cap.

The measure, introduced in both the House and Senate, would raise the cap on economic damages for oil spills from $75 million to $10 billion, meaning companies like BP would be forced to pay more than 133 times what they are now required to. That money would be in addition to the direct costs of cleanup, which the responsible party already must pay.

In short - there was a form of government waiver type insurance for any clean-up costs over $75 million, and with BP spending recklessly, and someone having made the dumb decision to go pour water on a semi-submersible drilling rig on an oil fire - and effectively sinking it making it worse; and now we all getting a first hand lesson in what can happen if there is problem a mile down - all of a sudden deep water drilling is not looking so much like "drill baby drill" anymore.

"The safety of its entire operations rested on the performance of a leaking, modified, defective blowout preventer," Stupak said.

When crews operating underwater robots attempted to activate the blowout preventers in the days after the spill, they discovered that there was a "significant leak" of the hydraulic fluid that activated the critical device designed to shut off oil in an emergency.

Crews working for Cameron, which manufactured the blowout preventer, discovered the leak coming from a loose connection. Cameron told the Congressional committee investigating this that it did not believe that the blowout caused the leak because other connections were tight.

Another shut-off system on the device had also been modified and did not work.

"An entire day's worth of precious time had been spent engaging rams that closed the wrong way because it was wired wrong."

A host of other problems may have interferred with the emergency shut-off system.

At least one battery located on the device, which was on the sea floor 5,000 feet beneath the surface, was dead. That could have prevented the device from operating in an emergency.

The blowout preventer had numerous potential ways to fail. The committee uncovered a document that identified 260 separate "failure modes," - so it was a complicated gross incompetence failure from usually a top notch team and drilling company.

In short, Cameron, the manufacturer of the blow out preventer said - "you folks modified it, screwed it up, and expected it to still work??

The price of everything, from petroleum to plastics, to the apples you buy in the supermarket and all the way to fresh seafood, is probably about to go UP. Count on it. We are a transportation intensive society - moving things around - everyday - all day long for not a lot of good reason. California Oranges in Florida, and Florida Oranges in California, and all that kind of non-sense in between.

The United States consumes an obscene amount of oil each DAY - and the figures below are from 2007!! It has gone up!!

United States: 20,680,000 bbl/day

China: 7,578,000 bbl/day

Japan: 5,007,000 bbl/day

Russia: 2,858,000 bbl/day

Each country decreases from there. See the full list at http://www.nationmaster.com/graph/ene_oil_con-energy-oil-consumption

Yes that is 20 MILLION, 680 thousand barrels per day.

The unprecedented oil spill came less than one month after President Obama decided to open up offshore drilling in the Atlantic, from Virginia to mid-Florida and the Gulf of Mexico. But last Thursday, the Department of the Interior halted all permits for any new exploratory drilling in the outer continental shelf, pending the outcome of a 30-day investigation -- a report is due May 28 -- into the cause of the Deepwater Horizon spill.

The U.S. gets more than a third of the oil it produces domestically from the Gulf of Mexico. Already 20% to 25% of this is from ultra-deepwater; and that share is rising as fields in shallower water decline in productivity.

What is keeping the price of US gasoline down - is fewer people driving and lower consumption right now.

The best way to keep this from happening again is for the general public to stop buying fossil fuel petroleum based fuel products - slow driving habits and fuel consumption overall - AND YES switch to a non-petroleum fueling source - on the fly fueled, low pressure Hydrogen - it can NEVER harm anyone.With gasoline prices rising at the pump in an election year, a new Obama administration report cites “significant progress” in reducing foreign oil imports and increasing domestic oil and gas production. (the rig pic above is the Deep Water Horizon rig before the mishap - we have another pic of out of the water being transported to another well site onboard the back of the "Mighty Servant" a semi-submersible transsport ship in another article)

Not so fast Kimsosabe . . .

More domestic drilling will not end the need for imports, however. The United States holds only 2 percent of the planet’s proven oil reserves, but Americans consume 25 percent of the world’s daily output of crude oil.

A report by six federal agencies was released early Monday March 12, 2012 on the first anniversary of a speech by President Obama in which he pledged to reduce American dependence on foreign oil imports by one-third in about a decade.

According to the study, the United States reduced net imports of crude oil last year by 10 percent, or 1 million barrels a day. America now imports 45 percent of its petroleum, down from 57 percent in 2008, and is on track to meet Obama’s long-term goal, the administration maintains.

We burn through - right now - 20 to 22 million barrels of oil per day. That is a huge amount of "Black Gold"

Imports have fallen, in part, because the United States has increased domestic oil and gas production in recent years.

U.S. crude oil production increased by an estimated 120,000 barrels a day last year over 2010, the report says. Current production, about 5.6 million barrels a day, is the highest since 2003.

But this is a joke. The US cannot sustain that kind of production, because the wells being tapped are low quantity reservoirs - they will run "dry" and to a lower production rate quickly.

One of the biggest producing wells we could have been using - we sealed up - we thought like a tomb - BP's infamous "Macondo Well" - the Gulf of Mexico deep water disaster that spewed oil for a few months.

BUT . . . it is not sealed - it is just out of site and out of "most" people's minds. It is in a mile deep of water, and no one can see it - but you cannot control mother nature will cement once a high pressure well like that has pierced the reservoir 3.5 miles MORE below the sea floor. The well was drilled in 5,000 feet of water to a depth of 18,360 ft below sea level (officially reported at 13,360 ft below the sea floor). Other reports - more likely to be more true, is that rig workers reported they had actually drilled to more like 22,000 feet below the sea floor.

The Macondo Well site, located just 40 miles off the Louisiana coast, is still leaking untold amounts of oil into the Gulf. Some argue that the casing on the capped well itself is leaking. Others believe oil is seeping through cracks and fissures in the seafloor caused by months of high-impact work on the site, including a range of recovery activities (some disclosed, some not) as well as the abortive “top kill” effort.

In January 2011, a prominent “geohazards specialist” wrote an urgent letter to two members of Congress – U.S. Reps. Fred Upton, chairman of the House Committee on Energy and Commerce and John Shimkus, chairman of the Subcommittee on Environment and Economy – suggesting that the Macondo site is leaking oil like a sieve. Here’s an excerpt from that letter (see it in its entirety below):

There is no question that the oil seepages, gas columns, fissures and blowout craters in the seafloor around the Macondo wellhead… have been the direct result of indiscriminate drilling, grouting, injection of dispersant and other undisclosed recover activities. As the rogue well had not been successfully cemented and plugged at the base of the well by the relief wells, unknown quantities of hydrocarbons are still leaking out from the reservoir at high pressure and are seeping through multiple fault lines to the seabed. It is not possible to cap this oil leakage.

BK Lim, the letter’s author, has more than 30 years of experience working inside the oil and gas industry for companies like Shell, Petronas and Pearl Oil.

More from Mr. Lim’s letter:

The continuing hydrocarbon seepage would have long term, irreversible and potentially dire consequences in the GOM (Gulf of Mexico)…

The letter is dated Jan. 14, 2011 – and we’ve been seeing more and more evidence that the scenario Mr. Lim describes is indeed taking place deep below the Gulf’s surface.

For example, on March 28, 2011, Paul Orr and his team from the Lower Mississippi Riverkeeper – an organization I’ve worked with frequently over the course of the last year – conducted a 50-mile boat patrol and sampling tour of Breton Sound, which lies just off the southeast coast of Louisiana. The excursion was prompted by multiple, increasingly frantic, reports of oil in the area by fishermen and others, including On Wings of Care pilot Bonny Schumaker, who has dozens of Gulf flyovers under her belt.

Mr. Orr took a sample from the southern end of Breton Island National Park – and sure enough, lab-certified tests results established a fingerprint match to BP’s Macondo Well (see link to my previous post and test results below).

The most alarming part of the finding was not simply that the Breton Island sample had BP’s fingerprint on it, but that the test results were nearly identical to those from the fresh oil seen in the early days of the BP spill – instead of the heavily weathered and degraded oil we’ve come to expect in recent weeks and months.

BP petrophysicist Galina Skripnikova in a closed-door deposition told attorneys involved in the oil spill litigation that there appeared to be a zone of gas more than 300 feet above where BP told its contractors and regulators with the then-Minerals Management Service the shallowest zone was located.

The depth of the oil and gas is a critical parameter in drilling because it determines how much cement a company needs to pump to adequately seal a well. Federal regulations require the top of the cement to be 500 feet above the shallowest zone holding hydrocarbons, meaning BP’s cement job was potentially well below where it should have been.

Cement contractor Halliburton recently filed a lawsuit against BP asserting that Skripnikova’s statements prove the oil giant knew about the shallower gas before the explosion and should have sought a new cement and well design. BP has denied the allegations.

AND . . . by all "first" accounts of the surviving rig workers - they DID know. Everyone on the righ was affair of what they called a "witchy well".

Skripnikova’s job involved analyzing data from BP’s Macondo well to determine the depth and characteristics of oil and gas deposits, which in turn is used in a process called temporary abandonment, when wells are sealed so they can be used for production later.

Based on the initial information, regulators approved BP’s well sealing plan, which called for placing the top of the cement at roughly 17,300 feet below the surface of the water. The cement was pumped April 19, the day before the explosion. But Skripnikova said that after she flew back from the rig she and others re-examined the analysis, and on the day of the explosion she identified the shallower gas zone. That would have meant the cement should have been placed at just under 17,000 feet below the surface of the water.

She said she did not relay that information to drilling engineers on the Deepwater Horizon and warn them to hold off proceeding with the abandonment. She suggested in her deposition that she thought the information would be passed up the chain. BP was already $60 million over budget and stopping operations at that point and coming up with a new cement design would have meant millions of extra dollars in costs.

No way did they pump 17,000 cubic feet worth of cement into the well to seal it "permanently".

The best way to have controlled the Macondo Well was to allow it to "naturally" pump oil to where we could use it. You cannot plug an inner tube under high pressure with concrete - it will always leak. The best way to control it today is to drill new wells around it at an angle to allow the pressure and oil to come up the new wells to stop the "leaking" of the primary well.

Even thought America has been the world’s largest producer of natural gas since 2009. Use of renewable sources of energy, such as wind and solar, is still relatively small but has doubled since 2008.

The report credits administration policies for the improvements. It cites initiatives like the higher fuel efficiency of passenger cars, the jump in renewable energy output, and improved weatherization of 1 million homes.

But independent analysts attribute much of the fall in oil imports to slack U.S. demand in a still-anemic economy. And to a certain degree, the boost in domestic oil and gas production is the result of decisions energy companies made during the George W. Bush administration to develop key reservoirs.

The report, titled “The Blueprint for a Secure Energy Future,” appears aimed, at least in part, at tamping down political fire from Obama’s Republican rivals and other critics who say his administration has not done enough to fight higher gasoline prices.

“We’re experiencing yet another painful reminder of why developing new American energy is so critical to our future,” the report states. “We know that there are no quick fixes to this challenge.”

Domestic gasoline prices rise and fall with global crude oil prices, which have been driven up by the gradual economic recovery and by market jitters over mounting tensions with Iran, one of the world’s largest oil producers. The closing of several U.S. refineries also has pushed gas prices higher.

Say what - refineries closed? Why? because gasoline is ot the ONLY thing refining oil produces and distribution costs of those other products can quickly make a refinery not profitable. sounds crazy - but it is true.

Most Americans are convinced that Obama and Congress could do more to reduce gasoline prices, according to a recent Gallup poll. BUT . . . they are wrong. gasoline prices are driven by supply and demand - and have been since the days of rockefeller and the original Standard OIl debaucle / scenario.

GOP candidates on the campaign trail and some oil industry leaders have charged that Obama’s energy policies stifle domestic production, and have urged the administration to open as much public land and offshore areas as possible to drilling.

It is true - it is a double edge sword one side chooses to show - versus the reality - simply illustrated by the incident result of BP's Macondo Well. We sealed a perfecty good high volume source of oil and natural gas - and even at that it continues to leak. Dumb, dumb, dumb. Monkey crap.

| Attachment | Size |

|---|---|

| mighty_servant_large.jpg | 127.1 KB |

,

,  ,

,  ,

,  ,

,  ,

,

,

,  ,

,

,

,  ,

,  ,

,  ,

,  ,

,  ,

,  ,

,

,

,  ,

,  ,

,  ,

,

,

,  ,

,  ,

,

,

,

,

,  ,

,  ,

,  ,

,  ,

,  ,

,

,

,

,

,  ,

,

,

,  ,

,  ,

,

,

,

,

,  ,

,  ,

,  ,

,  ,

,

,

,  ,

,  ,

,

,

,  ,

,